Georgia payroll tax calculator

On the other hand if you make more than 200000 annually you will pay. Ad Payroll So Easy You Can Set It Up Run It Yourself.

80 000 Income Tax Calculator New York Salary After Taxes Income Tax Payroll Taxes Salary

Calculate your Georgia net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Georgia paycheck.

. What is the income tax rate in Georgia. Calculate your state local and federal taxes with our free payroll income tax calculator simply choose your state and you are all set. Below are your Georgia salary paycheck results.

Georgia Paycheck Calculator 2021 - 2022. Get a free quote today. This guide is used to explain the guidelines for Withholding Taxes.

The results are broken up into three sections. Get a free quote today. Georgia Payroll Tax Rates.

Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in Georgia. Michelle Adams Last Updated. Ad This is the newest place to search delivering top results from across the web.

This includes tax withheld from. This Georgia hourly paycheck calculator is perfect for those who are paid on an hourly basis. How to use Free Calculator.

Paycheck Results is your gross pay and specific deductions from your paycheck Net Pay is. Ad Compare This Years Top 5 Free Payroll Software. Georgia payroll calculators Latest insights The Peach State has a progressive income tax system with income tax rates similar to the national average.

As of 2022 the Medicare tax is 145 of your wage and the social security tax is 62 of your salary. You wont be alone in. Free Unbiased Reviews Top Picks.

All you have to do. 0 1 minute read. The Georgia Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and Georgia State.

The first thing you need to know about the Georgia paycheck calculator. Find 10 Best Payroll Services Systems 2022. Use the Georgia paycheck calculators to.

To use our Georgia Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button. Free Unbiased Reviews Top Picks. The state income tax rate in Georgia is progressive and ranges from 1 to 575 while federal income tax rates range from 10 to 37 depending on.

Ad Process Payroll Faster Easier With ADP Payroll. Calculate your taxable income Adjusted gross income Post-tax deductions Exemptions Taxable income understand your tax liability Taxable income Tax rate Tax. Ad The New Year is the Best Time to Switch to a New Payroll Provider.

Ad Accurate Payroll With Personalized Customer Service. Get Started With ADP Payroll. Ad Compare This Years Top 5 Free Payroll Software.

Compare the Best Now. All inclusive payroll processing services for small businesses. Georgia has among the highest taxes on alcoholic beverages in the country.

Withholding tax is the amount held from an employees wages and paid directly to the state by the employer. Affordable Easy-to-Use Try Now. Well do the math for youall you need to do is enter.

All Services Backed by Tax Guarantee. 2022 Employers Tax Guidepdf 155 MB 2021 Employers Tax Guidepdf 178 MB. Discover ADP Payroll Benefits Insurance Time Talent HR More.

In 2022 the Georgia state unemployment insurance SUI tax rate will sit at 27 for new businesses with the maximum taxable wage base set at 9500. Simply enter their federal and state W-4 information as. Georgia Hourly Paycheck Calculator Change state Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4.

After a few seconds you will be provided with a full breakdown. The Peach States beer tax of 101 per gallon of beer is one of the highest. Georgia Alcohol Tax.

Payroll Tax Salary Paycheck Calculator Georgia Paycheck Calculator Use ADPs Georgia Paycheck Calculator to estimate net or take home pay for either hourly or salaried. Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees in Georgia. Figure out your filing status.

Content updated daily for ga payroll calculator. Luckily our Georgia payroll calculator eliminates all the extra clutter associated with calculating payroll so your administrative duties wont be quite as dull.

Payroll Calculator Free Employee Payroll Template For Excel

Georgia Paycheck Calculator Smartasset

Paycheck Calculator Take Home Pay Calculator

Calculate Your Net Income Manitoba Give Tax Rates Pensions Contributions And More Net Income Income Tax Income

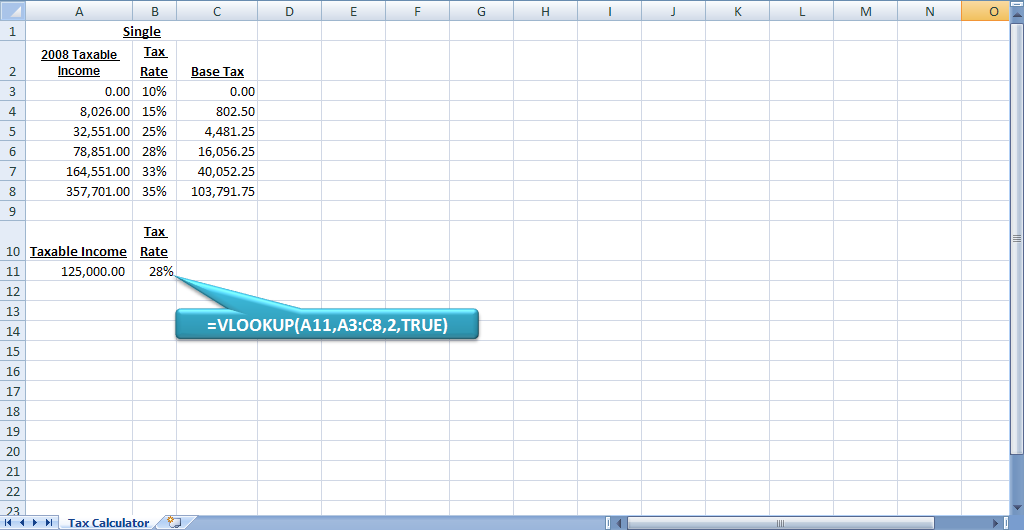

Build A Dynamic Income Tax Calculator Part 1 Of 2 Accounting Advisors Inc

Free Corporation Tax Filing With Accounting Package Available At Abacconsulting Taxation Tax Accounting Account Filing Taxes Income Tax Income Tax Return

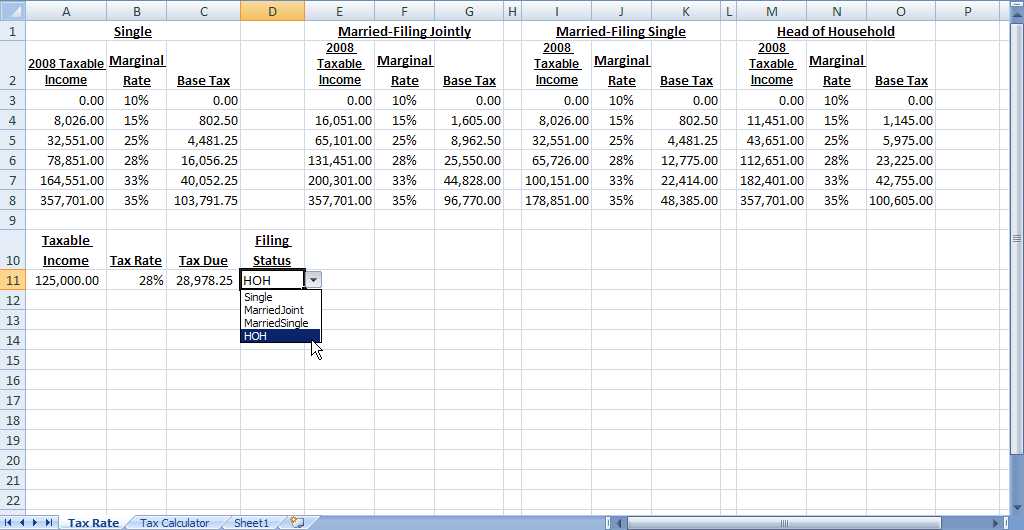

Build A Dynamic Income Tax Calculator Part 2 Of 2 Davidringstrom Com

Payroll Tax What It Is How To Calculate It Bench Accounting

Paycheck Calculator Take Home Pay Calculator

Free Online Paycheck Calculator Calculate Take Home Pay 2022

Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Salary Calculator Paycheck Pay Calculator

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Excel Formula Basic Tax Rate Calculation With Vlookup Exceljet

How To Calculate Sales Tax In Excel Tutorial Youtube

Free Employer Payroll Calculator And 2022 Tax Rates Onpay

Payroll Tax Calculator For Employers Gusto